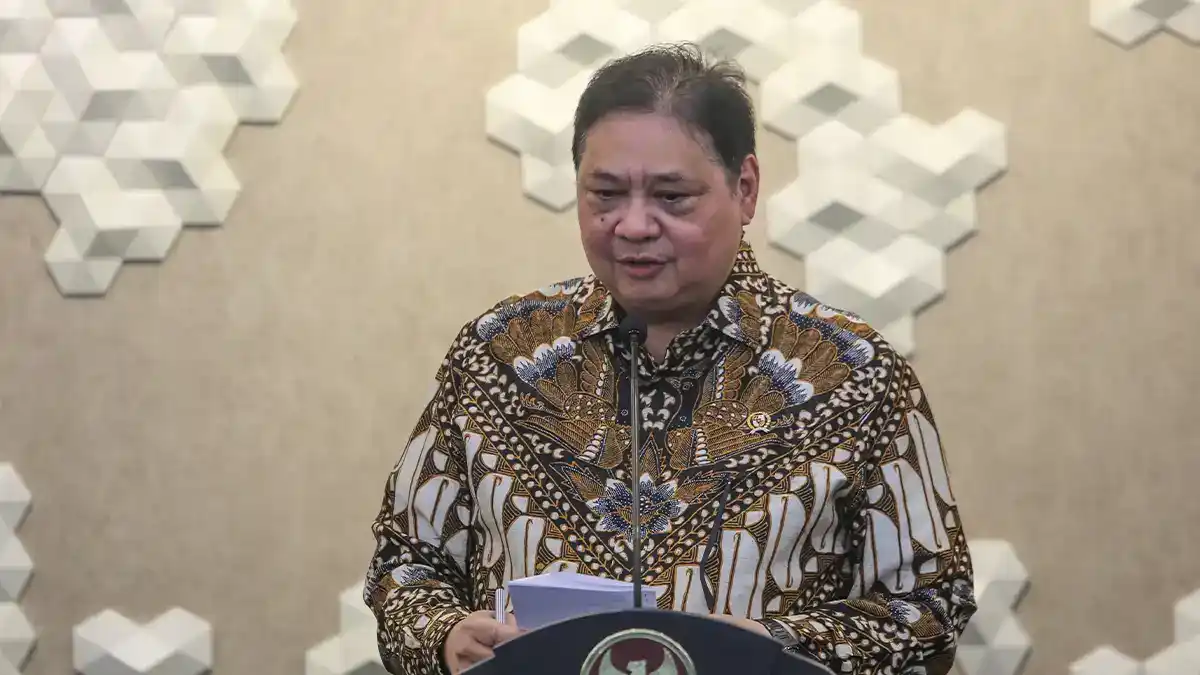

Tax Discourse on Online Merchants, DGT Claims Entrepreneurs’ Support

JAKARTA, DDTCNews - Online merchants operating on marketplace platforms will be subject to Art. 22 Income Tax through the platforms they use to transact. This issue has captured significant attention from netizens over the past week.

According to an official government statement, the Directorate General of Taxes (DGT) is to designate marketplace operators as Art. 22 Income Tax collection agents. This implies that the DGT will require these marketplaces to collect Art. 22 Income Tax on transactions involving goods sold by merchants through the marketplace platforms.

“By involving marketplaces as collection agents, Art. 22 Income Tax collection mechanisms are expected to promote proportional compliance as well as ensure that tax contributions align with the actual business capacity,” states the DGT in its statement.

The DGT outlines 6 points in its official statement. First, the provision does not imply the imposition of a new tax.

Rather, it modifies the payment mechanisms—shifting from self-payment by online merchants to collection by the designated marketplaces under the Art. 22 Income Tax collection scheme.

It is important to understand that, as a matter of principle, income tax is imposed on any increase in economic capacity received or accrued by a taxpayer, including income from online sales of goods and services.

This policy does not alter this fundamental principle but rather offers convenience for merchants in fulfilling their tax obligations. This is due to the streamlined tax payment process through a collection system integrated with the platforms these merchants use to sell.

Second, individual domestic merchants with an annual turnover of up to IDR500 million are excluded from income tax under this scheme pursuant to existing regulations.

Third, these mechanisms are intended to ease administrative processes, enhance compliance and ensure equal tax treatment among entrepreneurs, without imposing any additional burden or creating new forms of taxation.

Fourth, the provision also aims to reinforce oversight of digital economic activities and reduce the shadow economy, particularly among online merchants who have yet to fulfil their tax obligations—whether due to a lack of understanding or reluctance to deal with administrative procedures deemed burdensome.

Fifth, the regulation concerning the appointment of marketplaces as Art. 22 Income Tax collection agents is currently undergoing finalisation within the government. Accordingly, once the regulation is formally enacted, the DGT will communicate it to the public in an open, comprehensive and transparent manner.

Sixth, the formulation of this policy has been informed by a process of substantive stakeholder engagement, including studies and discussions with e-commerce industry representatives as well as relevant ministries and institutions.

“To date, responses to the proposed regulation indicate support for the government’s objective of establishing a more equitable and efficient tax governance—one that aligns with the evolving landscape of information technology,” the DGT elaborates.

Beyond the discussion on Art. 22 Income Tax collection for online merchants, several other noteworthy topics have emerged this week. These include concerns regarding the high turnover threshold for VAT collection agents, instructions from the director general of taxes instructing all personnel to reject gratuities and ongoing discourse on the evaluation of the personal tax relief (penghasilan tidak kena pajak/PTKP in Indonesian) threshold.

The following is a comprehensive summary of the tax articles.

Entrepreneurs Express Support E-Commerce Tax

Entrepreneurs have voiced their support for the DGT's plan to appoint marketplace platform operators as Art. 22 Income Tax collection agents.

Secretary of the Advisory Board of the Indonesian Employers Association (Asosiasi Pengusaha Indonesia/Apindo in Indonesian) Suryadi Sasmita expressed approval of the government’s decision to ‘transition’ from the self-payment mechanisms by online merchants, to a system where Art. 22 Income Tax is collected ney, goods, gi by marketplaces as the appointed parties.

“We support the imposition of the 0.5% final income tax on online merchants pursuant to Gov. Reg. 55/2022, commonly referred to as the MSME final income tax scheme,” stated Suryadi.

Concerns over High Threshold for VAT Collection Agents

Debate has also resurfaced over the perceived excessive turnover threshold for value added tax (VAT) registration. This time, the recommendation for Indonesia to reassess its taxable person (pengusaha kena pajak/PKP in Indonesian) threshold was put forward by the ASEAN+3 Macroeconomic Research Office (AMRO) in a recent report.

Indonesia’s VAT collection system has been criticised for its inefficiency, attributed in part to the high taxable person threshold and the wide array of goods and services excluded from VAT. This inefficiency is evident in Indonesia’s low VAT C-efficiency ratio.

Currently, the taxable person threshold in Indonesia is set at IDR4.8 billion (approximately USD315,000). In comparison, neighboring countries such as Vietnam, Thailand and the Philippines apply significantly lower thresholds, generally below USD55,000.

DGT Employees Strictly Prohibited from Accepting Gratuities

Director General of Taxes Bimo Wijayanto has urged all taxpayers and stakeholders to refrain from offering and/or giving money, goods or gifts in whatever form, including parcels or hampers, to DGT employees.

The appeal is outlined in Announcement No. PENG-2/PJ/2025 concerning Antigratification Appeal within the DGT in 2025. The DGT highlights that accepting gratuities constitutes a criminal offence if not reported to the Corruption Eradication Commission (Komisi Pemberantasan Korupsi/KPK in Indonesian).

“Gratuities related to civil servants’ positions that contradict their duties or obligations are deemed a bribery and criminal act if not reported to the Corruption Eradication Commission,” outlined the DGT in Announcement Number PENG-2/PJ/2025.

Has the Increase in Personal Tax Relief Boosted Economic Growth?

In 2016, the government raised the personal tax relief threshold from IDR36 million to IDR54 million annually. On a monthly basis, this adjustment increased the threshold from IDR3 million to IDR4.5 million.

This implies that only individuals earning more than IDR4.5 million per month (or IDR54 million annually) are subject to income tax. The year 2025 marks the ninth year since the enactment of these provisions.

However, based on two key indicators, i.e, economic growth and household consumption, the increase in personal tax relief has not demonstrated a direct, measurable impact on these 2 aspects. Moreover, tax relief alone is not a comprehensive solution for stimulating public purchasing power.

Taxpayer Data Used in Fraud Did Not Originate from DGT

The DGT has confirmed that the data and information exploited by fraudsters in their schemes do not originate from the authority’s internal system.

In several instances of fraud under the guise of the DGT, fraudsters have been found using taxpayer data or identity, for instance, full names, mobile phone numbers and residential or business addresses.

“I am confident that this is not a data breach from within the DGT as the DGT continues to enhance its security system to ensure the protection of taxpayer data”, remarks the DGT Director of Tax Dissemination, Services, and Public Relations Rosmauli. (sap)

Cek berita dan artikel yang lain di Google News.