New Tax Regulations: Audits & Input VAT Crediting in Different Periods

JAKARTA, DDTCNews - The government has reintroduced provisions on tax audits through the issuance of MoF Reg. 15/2025. This topic has sparked considerable attention from netizens over the past week.

The regulation concerning audits has been updated in line with the entry of force of Law 7/2021 concerning the Harmonisation of Tax Regulations (HPP Law). On another note, MoF Reg. 15/2025 has been issued to streamline regulations concerning tax audits.

“To provide legal certainty to tax audits, including land and building tax audits, which are currently stipulated under several regulations in the field of taxation, it is necessary to simplify and re-stipulate provisions on tax audits in one MoF Reg.,” reads the consideration of MoF Reg. 15/2025.

The provisions on tax audits were spread across three minister of finance regulations. First, MoF Reg. 17/2023 concerning Procedures for Audits. Second, MoF Reg. 256/2014 concerning Procedures for Land and Building Tax (L&B Tax or Pajak Bumi dan Bangunan/PBB in Indonesian) Audits and Examination.

Third, Article 105 of MoF Reg. 18/2021 concerning the Implementation of Law Number 11 of 2020 concerning Job Creation in the Field of Income Tax, Value Added Tax and Sales Tax on Luxury Goods as Well as General Provisions and Tax Procedures.

The provisions under the three aforementioned regulations have been re-stipulated and consolidated into MoF Reg. 15/2025. As such, the entry of force of MoF Reg. 15/2025 starting 14 February 2025 simultaneously repeals the three minister of finance regulations.

The most notable changes are related to the scope, type of audits and criteria for audits.

Pursuant to MoF Reg. 15/2025, audits to assess compliance with tax obligations are now conducted using three types of audits, namely: complete, focused and specific. These three types of audits were not present under former regulations.

In addition, the criteria for actions that will be subject to audits for other purposes have been revised. Previously, only twelve criteria determined which actions were subject to audits for other purposes.

Currently, MoF Reg. 15/2025 expands the criteria for actions subject to audits for other purposes to 25 types. Under MoF Reg. 15/2025, audits for other purposes are conducted, inter alia, to evaluate the tax facilities that have been granted.

Additionally, public attention has also been drawn to the tax authority’s clarification of input VAT crediting.

In response to public demand, the DGT has issued a written statement addressing input VAT crediting in the era of the coretax administration system, wherein the DGT conveys five main points.

According to the DGT, input VAT may be credited in different taxable periods as permitted by Article 9 paragraph (2) and paragraph (9) of the VAT Law. Further, no article under MoF Reg. 81/2024 explicitly prohibits input VAT crediting in different taxable periods.

“Therefore, to accommodate the needs of taxable persons, the coretax application has been updated to allow input VAT in e-faktur to be credited against output VAT for a maximum of three taxable periods,” states the DGT in KT-08/2025.

The DGT also highlights that currently, no amendment to MoF Reg. 81/2024 is required.

Beyond the two pieces of information above, several noteworthy tax topics merit further exploration. These include the types of audits in compliance assessments, provisions on the deposit of export proceeds, tax case resolution productivity across judicial bodies and the future of the global minimum tax in Indonesia.

The following is a comprehensive review of these key tax articles.

Three Types of Audits in Assessment of Compliance

An audit to assess compliance with the fulfilment of tax obligations is conducted using the type of complete audits, focused audits or specific audits as stipulated under Reg. 15/2025.

Pursuant to Article 2 paragraph (1) of MoF Reg. 15/2025, the director general of taxes is authorised to conduct Audits which aim to assess compliance with the fulfilment of tax obligations and for other purposes in the context of implementing statutory provisions in the field of taxation.

“An Audit to assess compliance with the fulfilment of tax obligations is conducted using the following types: a. complete audits; b. focused audits; or c. specific audits,” reads Article 2 paragraph (2) of MoF Reg. 15/2025.

Natural Resource Export Proceeds Deposited Domestically for a Year

The government will require exporters to deposit 100% of their natural resource (Sumber Daya Alam/SDA in Indonesian) export proceeds (Devisa Hasil Ekspor/DHE in Indonesian) for one year, from the current minimum of 30% and within a period of three months.

President Prabowo Subianto announced that the policy of depositing 100% natural resource export proceeds for one year domestically will take effect on 1 March 2025. This policy has been stipulated under Gov. Reg. 8/2025 which revises Gov. Reg. 36/2023.

“To date, our export proceeds funds—in particular, from natural resources, have largely been deposited overseas in foreign banks. To strengthen and magnify the impact of managing these natural resource export proceeds, the government has enacted Gov. Reg. 8/2025,” he remarked.

Productivity of Tax Case Resolution Soars

The Supreme Court (Mahkamah Agung/MA in Indonesian) recorded an increased productivity ratio of case resolution in the appellate courts across judicial bodies and the Tax Court throughout 2024.

The productivity ratio of case resolution at the appellate court and the Tax Court in 2024 stood at 80.56%, marking an increase of 5.08% when compared to the productivity ratio in 2023.

“The caseload in 2024 totalled 58,205, consisting of 44,859 new cases, and 13,346 pending cases from 2023. Of the total, 46,860 cases have been decided,” said Chairperson of the Supreme Court Sunarto.

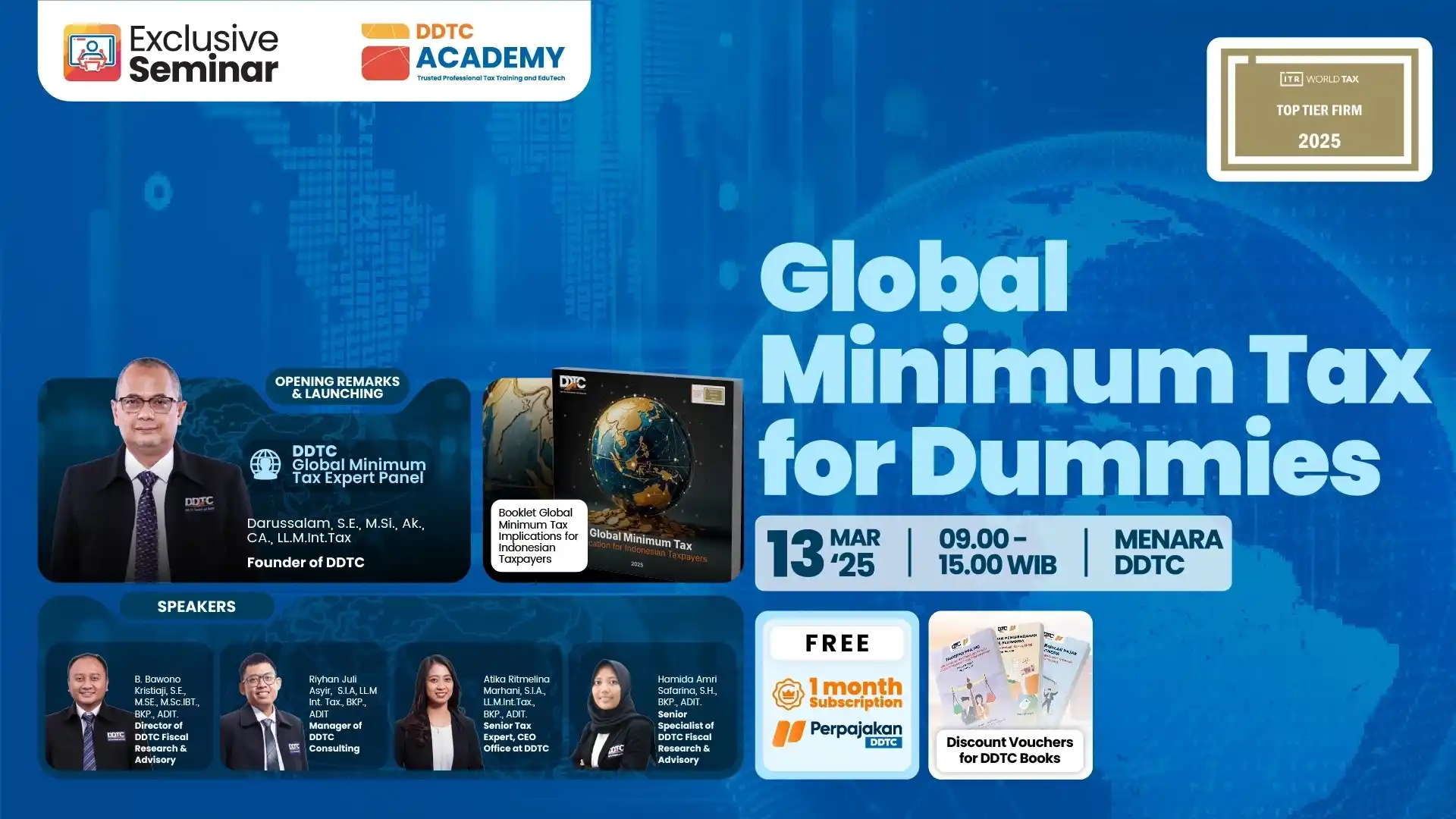

What Does the Future Hold for the Global Minimum Tax in Indonesia?

Coordinating Minister for the Economy Airlangga Hartarto affirms that the implementation of the global minimum tax is contingent on global conditions. The current global minimum tax is currently stipulated under MoF Reg. 136/2024.

Airlangga remarks that the government is presently discussing the future implementation of the global minimum tax. According to him, the government will continue to monitor government developments to determine the continuation of the policy implementation.

“We are currently discussing the mechanism and will monitor the global situation,” he added.

Additional Methods to Log in to Online DJP

The DGT has added a multi-factor authentication (MFA) method to log in to DJP Online, namely using the mobile authenticator application.

The addition implies that there are now 4 MFA methods for taxpayers to choose to log in to DJP Online. The four MFA methods comprise short messages (SMS), electronic mail (email), M-Pajak application and mobile authenticator.

“Now, there is an additional Multi-Factor Authentication (MFA) method to log in to DJP Online, namely using the mobile authenticator application,” explained the DGT. (sap)

Cek berita dan artikel yang lain di Google News.