Highlighting Civil Society’s Role in Overseeing UN Tax Convention

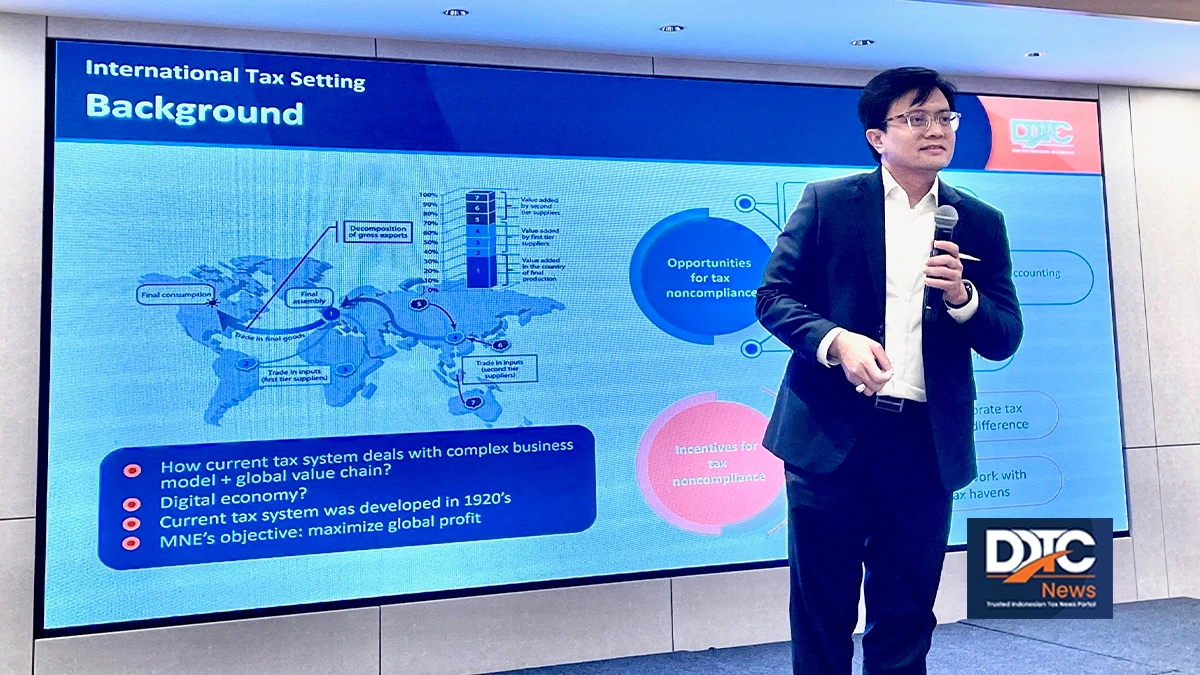

Managing Partner DDTC David Hamzah Damian delivered his presentation at the Capacity Building of Civil Society Organisations in Asia for an Effective Advocacy on the UN Tax Convention in Bangkok, Thailand, Thursday (13/3/2025).

BANGKOK, DDTCNews – The discourse on international tax issues has evolved rapidly and dynamically over the last decade. All stakeholders, including civil society, must actively engage in understanding these developments.

Why is it necessary? The impact of various international tax policies on Indonesia is inevitable, ultimately affecting Indonesian taxpayers.

To address the urgency of understanding international tax matters for civil society, several civil society organisations (CSOs) held a capacity building event, presenting a lineup of competent speakers in the field of taxation. The event took place in Bangkok, Thailand, on 13-14 March 2025.

One of the notable experts in attendance was Managing Partner of DDTC Consulting David Hamzah Damian. Before the capacity building participants, David shared his insights and expertise on the current dynamics of international tax issues.

As widely recognised, the issue of tax avoidance by multinational enterprises has yet to be resolved. Based on the Tax Justice Network report in 2024, countries lose US$492 billion annually due to tax avoidance by multinational enterprises and high-net-worth individuals.

In his opening remarks, David elaborated that on the one hand, tax sovereignty allows a country to regulate its tax system independently. On the other hand, it also fuels lead to tax competition. Consequently, challenges, such as tax haven countries, tariff wars and tax rights oriented to domestic resource mobilisation have emerged.

“Tax competition has been leveraged by multinational enterprises through planning, avoidance or worse, tax evasion—resulting in tax base erosion and profit shifting,” stated David.

In response to this situation, the OECD initiated a global tax agreement referred to as the G-20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS). This measure has engendered the Two Pillar Solution.

However, questions remain in terms of the effectiveness of the G-20 Inclusive Framework on BEPS to provide optimal benefits for low-income countries through the Pillar 2 Solution.

In the process of producing the policy, a number of stakeholders criticised the formulation process of the 2-Pillar Solution due to its lack of inclusivity.

“From the deadline to respond to drafts or the undemocratic voting system,” said David.

The policies under the OECD G-20 Inclusive Framework on BEPS, in particular, Pillars 1 and 2, are deemed by academics and international tax observers to favour developed countries. Moreover, the policy structure is viewed as inadequately accommodating to the interests of low-income countries.

Another criticism against the 2-Pillar Solution is its intricate working mechanisms, which countless fear disproportional to the benefits it has to offer to by low-income countries.

“The benefits a country gains from the implementation of Pillars 1 and 2 have never been expressly outlined by the OECD. As a result, the implementing countries cannot accurately assess the potential state revenues,” said David.

Amidst widespread dissatisfaction with the process and implementation of the G-20 Inclusive Framework on BEPS, a group of countries took the initiative to develop a new forum better suited to their economic conditions.

Finally, an ad hoc committee established by the United Nations (UN) officially approved the Terms of Reference (ToR) concerning the establishment of the United Nations (UN) Tax Convention. The introduction of the UN Tax Convention is expected to foster inclusive global tax cooperation and support Domestic Resource Mobilisation (DRM) efforts.

The UN Tax Convention aims to ensure that multinational enterprises pay their fair share of taxes, regardless of where they operate.

Tax cooperation under the UN Tax Convention is formulated to generate additional revenues for all countries, in particular, developing countries. The collected funds will be allocated by countries to meet their own development needs.

"This capacity building aims to increase the capacity of CSOs in analysing key issues revolving around international taxation, specifically concerning the UN Tax Convention," said David in his presentation.

As such, how does it relate to CSOs? David explained that in planning the UN Tax Convention, CSOs play a pivotal role in providing recommendations and overseeing through representatives at the UN. Through the United Nations, the voices of low-income countries will be heard deliberatively, rather than just through voting mechanisms.

“CSOs can advocate for the importance of an analysis of the UN Framework Convention proposal as well as its impact on taxation within their respective countries,” David continued.

On a related note, this capacity-building event was organized by several CSOs, including LDC Watch, the South Asia Alliance for Poverty Eradication (SAAPE), The PRAKARSA, and Oxfam in Asia.

Speakers in the capacity building, from left to right: Executive Director of The PRAKARSA Ah Maftuchan, SAAPE Core Committee Member Nalini Rathnarajah, National Confederation of Dalit and Adivasi Organisations (NACDAOR) Ashok Kumar Bharti, Managing Partner of DDTC Consulting David Hamzah Damian, NACDAOR Sumedha Bodh and Global Coordinator of LDC Watch Arjun Kumar Karki.

A number of these CSOs have also been actively advocating against tax abuse and illicit financial flows at the UN level. Additionally, the civil society organisations have also submitted responses to the Ad Hoc Committee regarding the UN Tax Convention's reference framework. (sap)

Cek berita dan artikel yang lain di Google News.